The United States economy returned to growth after having shrunk in each of the first two quarters of 2022. This is an outcome of a number of factors, including the strong job market and steady consumer spending. However, there is still a risk of recession next year as the Federal Reserve continues to raise interest rates.

Many reports still suggest that the inflation rates in the US are near a 40-year high, making thousands of households feel the flames of it. It’s anticipated that if the interest rates keep rising, The housing market will be delayed, and there will be greater damage to the internal markets.

Furthermore, the longer the Russian-Ukraine war drags, the outlook of the world economy grows darker. However, for now, the US economy has been recorded as performing well in comparison to the first two quarters of 2022.

Even economists expect the same result on Thursday after the issuance of the first three GDP estimates for the period of July-September.

According to a survey done by Reuters economists, the gross domestic growth has likely bounced back at a rate of 2.4% in the last quarter. The same was contracted to 0.6% in the second quarter of 2022. The estimates have a range of lowest 0.8% growth rate and highest at 3.7%.

There are various factors that lead to this growth in the third quarter. Notably, the job market has put itself forward, and employers have added about 420,000 jobs in a month. Now, this has been registered in the Labour Departments’ records as the second-best year in terms of job creation after 2021.

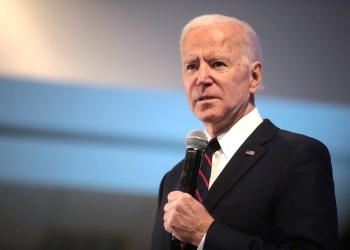

On the other hand, the Americans are a little worried about the report that’ll be issued on Thursday. Most are clutched about the high prices and recession risks. This also becomes a concern for President Joe Biden as all of this is happening amidst the mid-term elections that are going to determine whether the Democratic Party will still have control of Congress.

Moreover, the US central bank recently raised its benchmark overnight interest rate to 3.00% – 3.25% from near zero in March. Now this predicts that the rate will most likely end the year in the mid – 4% range.

As the Fed keeps raising the interest rates aggressively in efforts to tackle the higher consumer prices, the risk of an economic downturn in the next year keeps increasing. Also, the increase in rates by the central bank, as mentioned above, was not the very first attempt this year but the fifth one. It’s anticipated that the central bank will raise it further in the coming weeks and in December as well.

One major reason for the slump in not only the US but the entire world, especially the poor countries, is the everyday escalating war situations between Russia and Ukraine. Recently, Russia has formed a new committee to boost weapon production and face the Ukrainian army with more force.

Such situations are resulting in increasing prices of energy & food and disruption in trade. Even the IMF downgraded its outlook for the 2023 global economy with respect to these situations.

Now, it’s only a matter of changing times that will raise the curtains of the upcoming situations.